BitMine Goes on ‘$827M Aggressive’ ETH Buying Spree After Crypto Market Crash

BitMine Immersion Technologies has launched one of the largest Ethereum accumulation moves in corporate history, purchasing over $827 million worth of ETH during the recent crypto market crash.

The company, which already holds the world’s largest Ethereum treasury, stated that the acquisition added 202,037 ETH to its reserves, bringing its total to 3,032,188 ETH, approximately 2.5% of Ethereum’s circulating supply.

The aggressive buying spree came amid a weekend market sell-off that saw more than $19 billion in leveraged positions liquidated.

Over 1.6 million traders were wiped out in 24 hours, according to CoinGlass data, as Bitcoin and Ethereum recorded $5.38 billion and $4.43 billion in long liquidations, respectively.

The broader market’s total capitalization dropped by over 9% to $3.8 trillion, with Bitcoin briefly plunging below $102,000.

Tom Lee Says Ethereum Entering ‘Supercycle’ as BitMine Nears 5% of ETH Supply

BitMine’s latest purchase lifted its total crypto and cash holdings to $13.4 billion as of October 12, including $12.9 billion in crypto assets and “moonshot” investments.

The company’s portfolio now includes 3,032,188 ETH, valued at $4,154 per token, 192 BTC, worth approximately $22 million, a $135 million equity stake in Nasdaq-listed Eightco Holdings, and $104 million in unencumbered cash.

BitMine’s chairman, Tom Lee of Fundstrat, said the company took advantage of the temporary market dislocation caused by the liquidation cascade.

“Volatility creates deleveraging, and this can cause assets to trade at substantial discounts to fundamentals,” Lee said.

“We acquired over 200,000 ETH during the downturn, moving more than halfway toward our goal of owning 5% of the total ETH supply.”

Lee also reiterated his view that Ethereum is entering what he calls a “Supercycle,” driven by artificial intelligence and the financial sector’s increasing integration with blockchain.

BitMine published Lee’s keynote from the Token2049 conference in Singapore as part of its October Chairman’s Message, in which he outlined the company’s long-term thesis for Ethereum accumulation.

BitMine’s rapid expansion has positioned it as the largest Ethereum holder globally and the second-largest public crypto treasury overall, behind Michael Saylor’s Strategy Inc. (MSTR), which controls 640,250 BTC valued at roughly $73 billion.

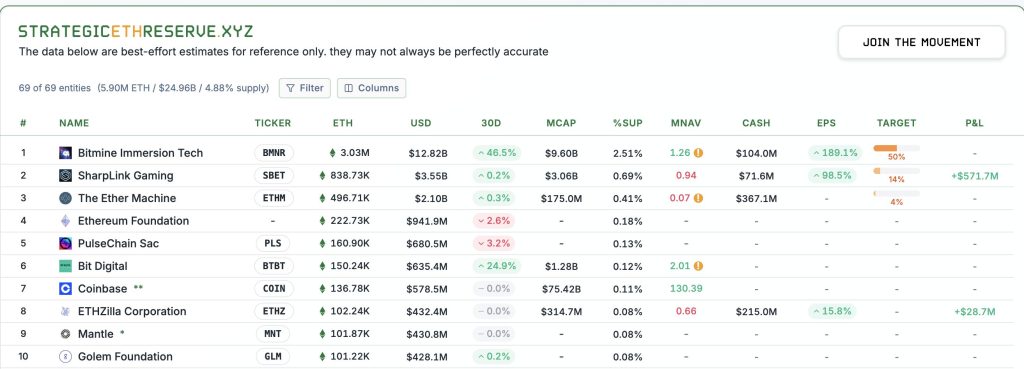

BitMine now ranks ahead of other central Ethereum treasuries, including SharpLink and The Ether Machine, which hold 838,730 ETH and 496,710 ETH, respectively, according to SER data.

Source: SER

Source: SER

Despite the market chaos, BitMine remains one of the most heavily traded U.S.-listed stocks.

Fundstrat data shows the company’s ticker, BMNR, has recorded an average five-day trading volume of $3.5 billion as of October 10, ranking 22nd among all U.S. equities, just behind Coinbase and ahead of UnitedHealth.

Combined, BitMine and Strategy account for 88% of global digital asset treasury (DAT) trading volume.

However, BitMine’s share price has not been immune to volatility, falling 11% over the past week following a short position taken by Kerrisdale Capital, which questioned the sustainability of the company’s business model.

Ethereum Eyes $10K as Fusaka Upgrade Nears Testnet Phase

Ethereum is positioning for another major leap as developers prepare for the Fusaka upgrade, expected to follow the successful Pectra rollout earlier this year.

The update, now entering testnet trials, is designed to reduce transaction fees further and lower the cost of becoming a validator, key steps toward improving scalability and accessibility across the network.

If Fusaka launches on schedule by late 2025, analysts believe it could strengthen Ethereum’s path toward $10,000, particularly as institutional interest in blockchain tokenization and real-world assets continues to expand.

Both Pectra and Fusaka form part of Ethereum’s long-term roadmap to enhance efficiency across the base layer and layer-two networks, such as Arbitrum.

Ethereum’s recovery from its previous low of $1,400 gained momentum after Pectra, with ETH/USD trading recently around $3,813.

However, volatility has remained high, as shown by a flash crash that wiped out over $3.8 billion in leveraged positions before prices rebounded above $4,100.

Technical indicators indicate that ETH is holding above support near $3,720, the 23.6% Fibonacci retracement level, suggesting a potential near-term reversal if resistance around $4,050–$4,300 is broken.

Meanwhile, renewed commentary from Rich Dad, Poor Dad author Robert Kiyosaki has drawn fresh attention to Ethereum’s dual role as a store of value and functional asset.

Kiyosaki warned of a looming financial reset and described Ethereum and silver as “hot, hot, hot,” arguing that both combine industrial utility with scarcity.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Cloud mining is gaining popularity around the world. LgMining’s efficient cloud mining platform helps you easily deploy digital assets and lead a new wave of crypto wealth.