Smart Money Is Buying the Dip with $1M in Bitcoin Hyper in 3 Days

KEY POINTS:

Bitcoin crashed Friday night, but $HYPER presale prices stayed locked, so early investors are protected from volatility.

Bitcoin crashed Friday night, but $HYPER presale prices stayed locked, so early investors are protected from volatility.

Whales accumulated $1M in 3 days before the crash, pushing Bitcoin Hyper past the $23M milestone.

Whales accumulated $1M in 3 days before the crash, pushing Bitcoin Hyper past the $23M milestone.

$HYPER aims to solve Bitcoin’s fatal flaw: slow speeds and no DeFi capability, using Solana speed with BTC security.

$HYPER aims to solve Bitcoin’s fatal flaw: slow speeds and no DeFi capability, using Solana speed with BTC security.

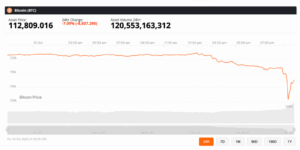

Bitcoin crashed Friday night. By Saturday morning, portfolios across the board were bleeding red. But there’s one group of investors who didn’t lose a single dollar: those who bought Bitcoin Hyper (HYPER) during the presale.

Source: BNC

Just days before the crash, whales poured $1M into $HYPER in 72 hours, pushing the project past the $23M milestone. While spot Bitcoin holders watch their investments evaporate, $HYPER presale buyers sit protected behind prices that never go down.

This is the advantage of presale allocations during volatile markets. You’re not trying to catch a falling knife. You’re accumulating fixed-price tokens in infrastructure that becomes more valuable as Bitcoin eventually recovers.

Bitcoin’s Fatal Flaw: Speed Kills Adoption

Bitcoin’s recent crash highlights a deeper problem that has nothing to do with price volatility. After 16 years, Bitcoin still can’t function as anything beyond digital gold.

It’s main problems:

- Crippling speed at 3-7 transactions per second

- Fees that spike to $50+ during network congestion

- Zero native support for the DeFi applications and dApp ecosystems that drive hundreds of billions in capital flow across Ethereum, Solana, and other chains

Every scaling solution has required fatal compromises. Lightning Network forces users to lock funds in payment channels with liquidity limitations. Sidechains introduce entirely new security assumptions that undermine Bitcoin’s core value proposition.

So Bitcoin holders sit on the sidelines watching other networks capture developer talent and user adoption while $BTC remains locked in its limited utility cage.

Bitcoin Hyper’s Solution: Solana Performance Without Bitcoin Compromises

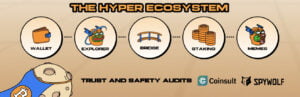

Bitcoin Hyper cracks the code by building the first genuine Layer-2 that merges Solana Virtual Machine speed with Bitcoin’s unmatched security architecture.

$BTC bridges into the Bitcoin Hyper network through a Canonical Bridge, creating wrapped $BTC that maintains a 1:1 peg. This wrapped version becomes the native currency for a high-speed ecosystem where developers can build using Rust-based SDKs and APIs, the same tools that made Solana a developer magnet.

Applications run at Solana-level throughput while every transaction anchors back to Bitcoin’s main chain for final settlement. No security trade-offs. No experimental consensus mechanisms. Just Bitcoin, finally operating at speeds that make real adoption possible.

As $BTC gets locked in the bridge, main chain supply contracts while utility explodes. More developer activity means more $BTC absorbed into the ecosystem, creating organic demand pressure that doesn’t rely on store-of-value narratives or hoping for the next bull run.

Here’s a better explanation of Bitcoin Hyper’s ecosystem.

Whales Positioned Before the Crash – $3.3M in One Week

The data reveals who saw this coming.

Since September 29, Bitcoin Hyper has raised $4.3M. Nearly $3.3M came from whale wallets in a single week, with accumulation accelerating in the days before Friday’s crash.

One address alone acquired 62.2M $HYPER tokens worth $833K. That wallet started buying during the previous weekend with 42.2M $HYPER, then added another 20M tokens on Monday, well before the Friday correction that caught retail off guard.

The whale buying triggered retail momentum. From Tuesday through Friday, another $1M flooded in as smaller investors recognized the pattern.

Presale prices remain locked at $0.013105 regardless of Bitcoin’s spot price chaos. Your entry point doesn’t change while you wait for $BTC to find its floor and resume climbing.

Current round closes in 28 hours. After that, the price automatically increases to the next tier.

See our Bitcoin Hyper price prediction to get a glimpse of its potential.

See our Bitcoin Hyper price prediction to get a glimpse of its potential.

Earn 50% APY While Waiting Out the Crash

Bitcoin Hyper’s staking protocol is already operational, offering 51% APY on staked tokens. Over 1B $HYPER are currently staked, generating passive income before the token generation event.

This creates a compounding advantage during uncertain times. You’re earning a substantial yield (50% now) throughout the entire presale and beyond.

By the time $HYPER lists publicly and Bitcoin stabilizes, your position has already grown significantly through staking rewards alone. The crash becomes an opportunity rather than a loss.

But remember that the staking APY will go down as more people stake tokens.

How to Buy Before the Price Increases in 28 Hours

To join the presale, visit the official website. $HYPER accepts $SOL, $ETH, $USDT, $USDC, $BNB, and credit cards. Here’s a step-by-step guide to buy Bitcoin Hyper.

Best Wallet, a top-rated Bitcoin and crypto wallet, lists $HYPER under its Upcoming Tokens section, making it simple to buy, track, and claim once the token goes live.

Bitcoin’s recovery timeline is uncertain, but presale prices stay locked regardless of how deep the correction goes or how long it takes $BTC to find support.

While panic sellers capitulate and bottom-fishers gamble on timing, smart money is accumulating in the Layer-2 infrastructure that finally makes Bitcoin functional for mass adoption.

Visit Bitcoin Hyper to secure your allocation before the 28-hour deadline.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail