Coinbase CLO Says Base Is “Not an Exchange” Amid SEC Scrutiny

Coinbase’s chief legal officer, Paul Grewal, has defended the company’s Ethereum Layer-2 network, Base, against suggestions that it should be regulated as a securities exchange.

Speaking in an interview with Bankless, Grewal argued that Base functions as blockchain infrastructure rather than a platform for matching securities trades.

“Base is just a normal blockchain,” Grewal said. “Yes, it’s a Layer-2. But that doesn’t change its relationship to securities laws. We are not matching buyers and sellers of securities. We are just a blockchain layer.”

He stressed that transaction matching occurs within applications built on top of Base, such as automated market makers or centralized limit order book protocols, not at the Layer-2 level itself.

Coinbase’s Base Balances SEC Scrutiny With Decentralization Push

His comments come amid growing debate over the role of Layer-2 sequencers. The U.S. Securities and Exchange Commission defines an exchange as a marketplace that matches buyers and sellers of securities.

Commissioner Hester Peirce has previously warned that centralized sequencers could resemble exchange matching engines and therefore fall within the SEC’s jurisdiction.

Ripple CTO David Schwartz has backed Grewal’s position, likening Layer-2 networks to cloud providers such as Amazon Web Services, which host exchange code but are not classified as exchanges themselves.

Ethereum co-founder Vitalik Buterin has also praised Base for combining centralized sequencing with Ethereum’s decentralized security model, describing the approach as key to improving user experience.

Base was launched in 2023 as a low-cost, developer-focused chain built on Ethereum. It has since become a popular scaling solution for decentralized finance applications.

Grewal warned that treating Layer-2 infrastructure as an exchange would impose heavy compliance burdens that could hinder innovation and slow the growth of the broader ecosystem.

The regulatory debate coincides with a shift in Coinbase’s approach to Base’s long-term roadmap. At the BaseCamp 2025 event in Vermont, Jesse Pollak, who leads the Base project, revealed that the team is “beginning to explore” launching a native network token.

The remarks marked a departure from Coinbase’s previous position that Base would not issue a token.

Pollak emphasized that no decision has been made on the design, governance, or timeline for a token launch but described the exploration as part of efforts to accelerate decentralization and expand opportunities for developers and creators.

The comments came a few weeks after the token distribution by Consensys’ Linea network, which released more than 9.3 billion LINEA tokens to eligible users.

Alongside token discussions, Base also announced an open-source bridge with Solana at BaseCamp, allowing interoperability between ERC-20 and SPL tokens.

The developments show both the rapid growth of the Layer-2 ecosystem and the unresolved regulatory questions facing infrastructure providers.

Base Emerges as a Growing DeFi Powerhouse Amid Shifts in TVL Rankings

Ethereum continues to dominate decentralized finance with $86.3 billion in total value locked (TVL), but Coinbase’s Base network is quickly establishing itself as one of the most active ecosystems in the market.

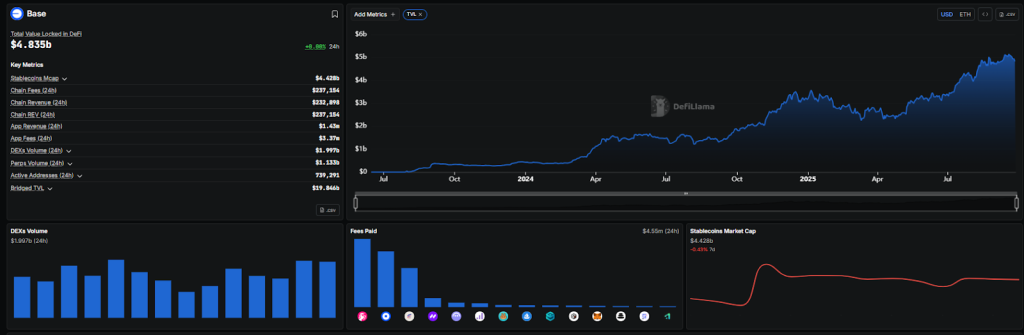

Base currently holds $4.83 billion in TVL across more than 700 protocols, showing steady monthly growth despite short-term fluctuations. Liquidity is largely stablecoin-driven, with $4.4 billion in circulating supply on the network, underpinning lending and trading activity.

Source: DeFiLlama

Source: DeFiLlama

Daily decentralized exchange (DEX) volumes approach $2 billion, while perpetuals trading adds another $1.1 billion—placing Base among the most liquid Layer-2s.

Chain-level efficiency also stands out. In the past 24 hours, Base captured $237,000 in fees, nearly all of which were converted to revenue. The network processed activity from nearly 740,000 addresses in a single day, showing its broad retail and institutional adoption.

Bridged liquidity stands far higher at nearly $20 billion, indicating large capital inflows that are not yet fully deployed in DeFi protocols.

Protocols fueling the ecosystem include Aerodrome, Uniswap, Aave, and Spark. Aerodrome remains a major liquidity hub, though it leans heavily on incentives, resulting in negative net earnings.

By contrast, Spark has emerged as one of the fastest-growing lending platforms, posting a 41% TVL increase over the past month. Risk management services such as Gauntlet and Block Analitica also highlight the maturing role of analytics in DeFi.

While Ethereum and Solana still command larger ecosystems, Base’s rapid rise, backed by Coinbase’s infrastructure and user base, is positioning it as a contender in the next wave of DeFi expansion.

Sustaining growth, however, may depend on whether protocols can reduce reliance on subsidies and maintain long-term liquidity.

You May Also Like

Where is the Bottom for Bitcoin?

China Launches Cross-Border QR Code Payment Trial