Cloudflare and Coinbase Launch x402 Foundation for Machine-to-Machine Web Payments – Here’s How it Impacts You

Cloudflare and Coinbase are launching the x402 Foundation to establish a universal standard for AI-driven payments, enabling machines to pay for web resources without human intervention automatically.

The protocol converts the HTTP “402 Payment Required” error code into a functional payment system, enabling AI agents to purchase data, services, and content directly.

Brian Armstrong, Coinbase’s CEO, called x402 “a big step forward” that allows AI agents to “transact value, not just exchange info.”

The protocol addresses a fundamental problem in the current payment systems, which were designed for humans clicking “buy” buttons, not machines making millions of automated transactions.

Every day, websites send over one billion HTTP 402 error codes to bots trying to access content, but these payment requests go unanswered because no standard exists for machines to respond.

The x402 protocol solves this by creating a common language for automated payments.

The initiative comes as Google recently announced similar stablecoin support for AI payments, partnering with Coinbase and the Ethereum Foundation.

Google’s James Tromans said stablecoins represent “probably one of the most important payment upgrades since the SWIFT network.”

Revolutionary Payment Flow Changes Everything for AI

The x402 protocol creates a simple four-step process that transforms how machines handle payments online.

When an AI agent tries to access restricted content, the server responds with payment instructions, including the amount and recipient details.

The agent then sends the payment authorization header along with its request.

A payment facilitator verifies the transaction and settles it automatically. Finally, the server delivers the content with confirmation that payment succeeded.

This system enables entirely new business models that were impossible with traditional payment systems.

An AI assistant could automatically buy Halloween costume accessories from multiple merchants.

Autonomous trading bots could pay per request for real-time market data feeds, rather than monthly subscriptions.

Cloudflare is proposing a “deferred payment scheme” that allows batch settlements at the end of each day rather than immediate transactions.

This approach accommodates crawlers that access thousands of pages before receiving a single aggregated bill through traditional payment methods or stablecoins.

The protocol supports both immediate blockchain settlements and delayed payments through credit cards or bank accounts. This flexibility ensures compatibility with existing financial infrastructure while enabling the implementation of new automated workflows.

Stablecoin Infrastructure Powers Machine Economy Growth

The timing coincides with explosive growth in stablecoin adoption for AI applications.

According to a report covered by Cryptonews in June, as of 2024, bots already account for 70% of stablecoin transfer volume, indicating machine-driven transactions are becoming dominant.

Traditional payment rails, such as wire transfers and credit cards, cannot handle the micropayments and instant settlements that AI agents require.

Stablecoins solve these limitations by providing programmable money that settles within seconds at minimal cost.

The stablecoin market has grown from $4 billion in 2020 to over $280 billion today, with monthly settlement volumes reaching $1.39 trillion in the first half of 2025. Major stablecoin issuers now rank 17th globally in U.S. Treasury holdings.

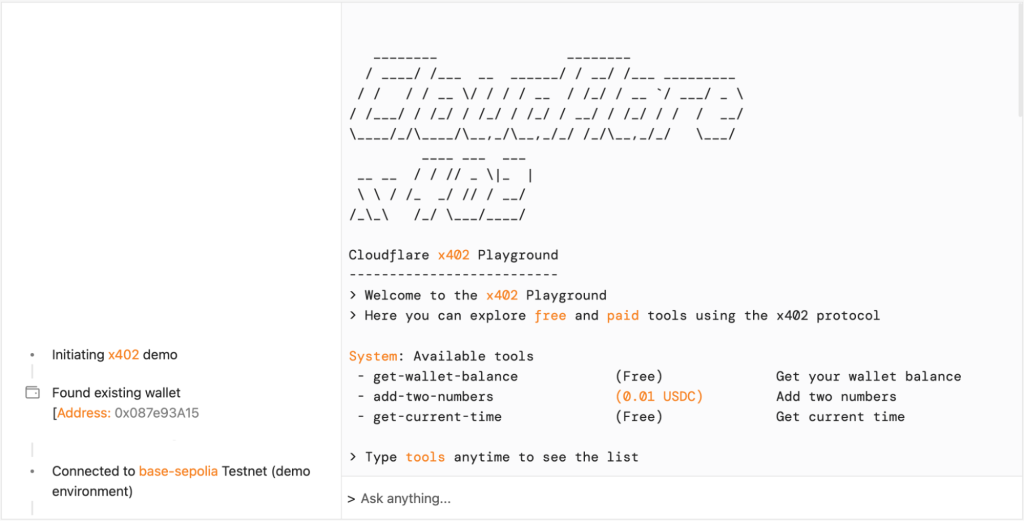

Cloudflare has created a live demonstration called the x402 playground, where visitors receive testnet USDC on the Base blockchain.

Source: Cloudflare

Source: Cloudflare

The demo shows agents automatically paying for computational tools while free services remain accessible without payment.

Amazon Web Services is exploring x402 integration for cloud compute payments, potentially transforming the $1.9 trillion cloud computing market expected by 2030.

Web3 storage platform Pinata uses x402 for pay-per-file storage, while AI platform Heurist leverages it for research payments.

In fact, Circle co-founder Sean Neville recently launched Catena Labs with $18 million in funding to create the first fully regulated AI-native financial institution.

The project positions stablecoins as “AI-native money” essential for autonomous economic systems.

While stablecoin adoption is growing massively, banking industry groups are pushing for stronger regulations, warning that the growth of stablecoins could trigger $6.6 trillion in deposit outflows from traditional banks.

However, earlier this month, Coinbase Research argued that most stablecoin activity occurs internationally, strengthening dollar dominance without impacting domestic deposits.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Unstoppable: Why No Public Company Can Ever Catch MicroStrategy’s Massive Bitcoin Holdings