The public game chain Ronin and the ecological game ROMW are caught in a Rashomon of mutual tearing, and users "pay the bill" for the breakup

Author: Zen, PANew

Recently, 0x&, the development team of Ragnarok: Monster World (ROMW), took the lead in launching the "multi-chain architecture" server on CROSS Protocol, announcing that the game process and token system will be completely independent of Ronin. The community immediately went wild over this move, criticizing its "soft rug" move and worrying about player rights and ecological prospects.

Just two days after the incident was announced, Sky Mavis co-founder and COO Aleksander Larsen publicly accused ROMW of "ignoring advice, secretly signing contracts with other chains, and seriously violating the cooperation agreement" on X on April 26, and announced the termination of its professional cooperation with 0x&. This series of events pushed the original deep cooperation into a crisis of trust. While the Ronin ecosystem was slightly damaged, ROMW's future became even more worrying.

Rashomon: Ronin and ROMW have different opinions

“The team ignored our advice and lost the support of the community. Worse, they secretly signed an agreement with another blockchain, violating our agreement. This was naturally unexpected considering our long-standing support for them. Trust has been broken to such an extent that we have decided to end our professional partnership with 0x&, the team behind Ragnarok: Monster World.”

Recently, Aleksander Larsen, co-founder and COO of Sky Mavis, the parent company of Ronin, published a post condemning the ROMW development team for "betraying" Ronin and announced a breakup with them. The honeymoon period between the two parties, which lasted only one year, has come to an end.

Ragnarok Online (Chinese translation: Ragnarok Online) is an MMORPG launched by Korean developer Gravity in 2002. This classic online game has attracted more than 100 million players worldwide and generated more than $2 billion in revenue. Following the classic IP of Ragnarok Online, 0x& launched the tower defense game Ragnarok: Monster World after obtaining authorization from Gravity, and announced in April 2024 that it would debut on the Ronin blockchain. According to the official press release at the time, 0x& not only established a partnership with Ronin, but also received investment from Sky Mavis.

In response to the accusations of Ronin co-creation, ROMW denied that any secret agreement had been reached, fulfilled all contractual obligations, and had transparent communication with Sky Mavis as early as February 2024, including a direct meeting with Aleksander Larsen. ROMW also stated that no matter what challenges it faces in the future, it will continue to operate games on Ronin, and further stated: "We believe that decisions made without regard to the interests of the community will ultimately undermine the uniqueness of Ronin."

Both sides have their own opinions, and the community is unable to tell which is true and which is false. However, in this Rashomon incident, the behavior and attitude of both Ronin and ROMW have disappointed players and the community.

From love to hate: Candy becomes Mrs. Cow

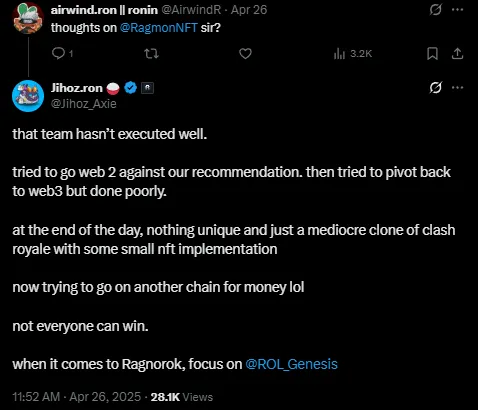

In fact, one day before Aleksander Larsen officially announced the breakup with ROMW , some community players had already discovered that there was an obvious rift between the two parties. In a post about the fishing game "Fishing Frenzy" that Ronin ecosystem has recently promoted, Ronin co-founder Jihoz criticized ROMW without hiding his criticism, saying that the game was just a "poor copycat version of Clash Royale." Jihoz said that ROMW was going to make money on other platforms, and directly criticized it, saying that he was now only focusing on "Ragnarok Landverse: Genesis."

"Ragnarok Landverse: Genesis" is also based on the Ragnarok IP, and the game design is closer to the classic original. It can basically be regarded as the Web3 version of "Ragnarok Online". Genesis was developed by the meta-game ecosystem developer Zentry (formerly GuildFi) and launched on Ronin at the end of March this year. Prior to this, Zentry's flagship game studio Maxion initially soft-launched "Ragnarok Landverse" on BNB Chain in September 2023 after obtaining the IP licensing cooperation, and the Genesis series released on Ronin can also be regarded as the latest adaptation and continuation of this version.

Jihoz's fierce criticism made some community users think that his words were a bit too harsh, and many players found it difficult to understand this inconsistency. After all, they were the ones who praised ROMW in the early days, and they are also the ones who are stepping on it now. In addition, Larsen, who posted a statement to express his split, also mentioned in his statement that because ROMW violated the trust regulations, they would take "punishment" - removing the game and its assets from Sky Mavis products, including deleting ROMW's related NFTs from the Ronin market.

This decision has also caused it to be questioned by the community. Some users called it over-centralized and a "typical manifestation of authoritarianism" and that an open blockchain should not go to this extent. There are also Ronin supporters who are not ROMW players who advise: "You should not remove their NFTs from your market. This is not the fault of the end users, and it mainly damages the trading ability of Ronin users." They hope that the credibility of the Ronin ecosystem will not continue to be damaged.

Later, Larsen issued a statement saying that they had listened to the community's feedback and would not completely remove Ragmon's assets from the Ronin market, but would remove the check mark to indicate that the official did not recognize or support the game. However, it is now much more difficult to search for ROMW-related NFT collections on the Ronin market. After ROMW officially announced that it would "find a new home" and after a confrontation between the two sides, the prices of related NFTs have fallen sharply across the board. In this contradiction, the only ones who are most hurt are the gamers who once believed in Ronin's official endorsement and ROMW's quality.

Can ROMW and its new love CROSS have a future?

ROMW's "new love" CROSS Protocol is a dedicated sidechain based on Ethereum that supports on-chain games and NFT ownership verification. It was developed by multi-platform game provider NEXUS, and governance is entrusted to the Swiss-registered non-profit organization Opengame Foundation. In March this year, CROSS Protocol announced the completion of a $10 million private token sale.

On April 23 , the ROMW development team 0x& published a series of posts discussing the fourth season, updates, and more. One of the posts, titled "ROMW on CROSS Beginner's Guide," surprised players. According to the introduction, the "multi-chain architecture" adopted by ROMW means that the games it runs on CROSS are completely independent of the existing Ronin servers, including independent game processes, token economics, and leaderboards.

This means that the developer is releasing the same game on other networks with almost no economic relationship between the two. For example, xZeny tokens are its in-game tokens in CROSS, and players need to buy battle passes to obtain them. This has no connection with the eZeny tokens in Ronin, which also require purchase vouchers to obtain, and cannot be exchanged. If a player wants to play on two servers with a single game account and wallet, he needs to use the network filters in the inventory to manage the assets he owns on each network.

ROMW's actions caused great anger in the community, and players strongly criticized it as a soft rug. After cutting the leeks of Ronin community players, it looked for other ways to continue to defraud players' assets.

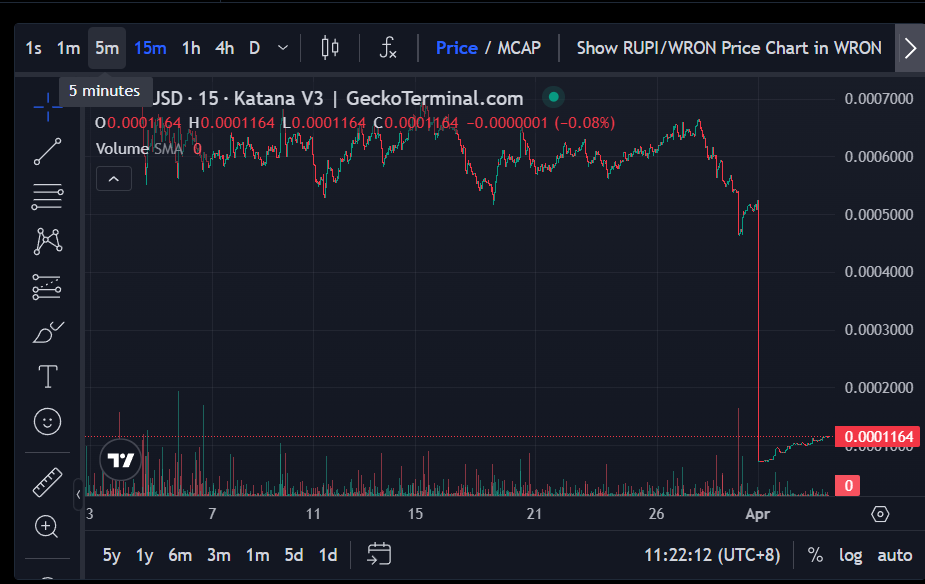

It is reported that in previous seasons, players will receive end-of-season ranking rewards in the form of eZeny tokens, which can be exchanged for temporary utility $RUPI, which can be traded on the decentralized exchange of the Ronin network. Affected by the recent series of events, the price of $RUPI has plummeted, and the price of NFT has also dropped to the lowest point. Therefore, those players who invested time and money in the original game will basically lose everything.

Players generally expressed anger and incomprehension about ROMW's switch to CROSS, mocking CROSS as a fake ecosystem full of robots. Some developers also said that ROMW's move was only because game development needed continuous resources and financial support, and Ronin, which has many top Web3 games and is open and unlicensed, obviously cannot provide the support ROMW wants.

But no matter what, for ROMW, which has already overdrawn its reputation and harmed the interests of players, there is little hope of re-establishing an active player community.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

NVIDIA Stock Price Analysis as OpenAI Issues Concerns About its Chips