Ethereum Maintains Range While Speculators Whisper About Rollblock Emerging As A Breakout Contender

Ethereum has held its ground in recent weeks, moving within a steady range just above $4,500 as trading volume cools. The token’s resilience keeps it firmly in the spotlight, even as attention drifts toward new projects making waves.

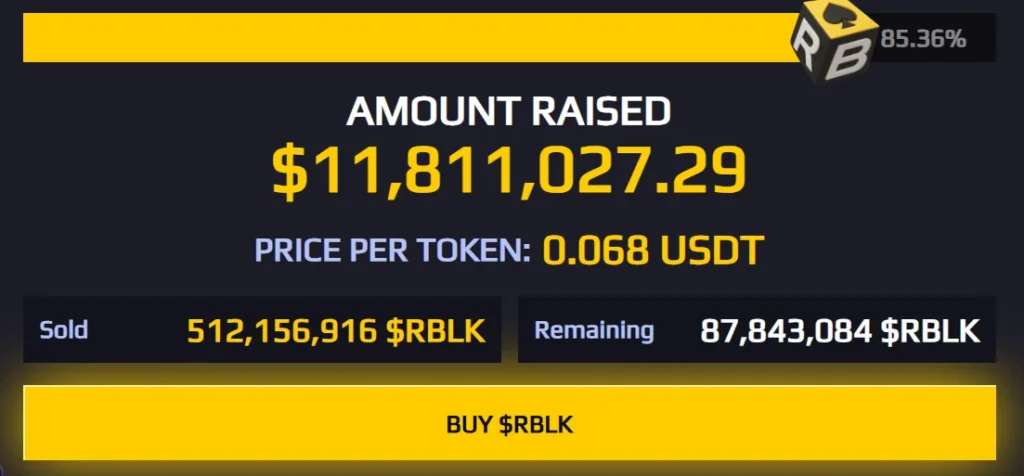

Rollblock (RBLK), now past $11.8 million raised, is one of those names drawing louder whispers. While Ethereum continues to anchor market confidence, Rollblock is being framed as a breakout contender with adoption fueling its early surge.

Ethereum Maintains Uptrend Despite Cooling Trading Volume

Ethereum has been trading in a contained range, finding stability just above $4,500 after its strong run earlier in the summer. The move from June’s low of $2,100 to nearly $4,956 marked one of its sharpest climbs of the year.

Source

Price action has since been subdued, as ETH has fallen into sideways trading as the market contemplates its next path. The short-term averages are narrow, indicating reluctance, and larger support levels are firm.

Trading has died down a notch since the burst in July and August, indicating that the momentum was not killed but merely slowed down. Ethereum’s strategic positioning above key moving averages suggests that the long-term framework is still in place, which holders are comfortable with despite weaker volume.

Market watchers are split on where ETH heads next. Optimists see another test of the $5,000 barrier, with some calling for $6,000 if institutional inflows continue at the pace.

More cautious views note that losing the $4,400 line could trigger deeper selling. For now, Ethereum sits in balance, steady but charged with anticipation for its next decisive move.

Speculators Whisper About Rollblock Emerging As A Breakout Contender

Rollblock (RBLK) is making its mark as one of the most anticipated projects heading into exchange listings. What separates it from the usual noise is not promises, but proof of adoption.

Before even touching a central exchange, the platform has already processed more than $15 million in wagers, supported by a library of over 12,000 games that cover everything from blackjack and poker to immersive live dealer tables.

Trust has also been central to its rise. Licensed by Anjouan Gaming and audited by SolidProof, Rollblock has taken steps to provide transparency, giving both players and investors a sense of reliability often missing in GameFi ventures.

On the economic side, its design blends scarcity with reward. Weekly revenue is channeled into token buybacks and burns, reducing supply, while staking pools reward those holding long-term.

Several core strengths are now driving momentum:

- Over 55,000 registered users are already active on the platform.

- A deflationary model reinforced by consistent buyback events.

- Integration of fiat payments, such as Visa and Apple Pay, for easier onboarding.

- Staking rewards are structured to deliver up to 30% APY.

Priced at $0.068 with more than $11.8 million already raised, Rollblock is gaining traction as a contender capable of shifting from presale success into broader market recognition.

Ethereum Holds Steady as Rollblock Races Ahead

Ethereum remains a stable force above $4,500, but Rollblock is capturing fresh momentum with a presale that has already raised more than $11.8 million at $0.068. With over 85% of tokens sold and adoption driving its growth, RBLK is shaping up as more than a short-term play. Many now believe Rollblock’s blend of gaming, staking, and deflationary design could see it surpass Ethereum’s market influence in the years ahead.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse