How is the xStocks tokenized stock market developing?

Author: Heechang

Compiled by: TechFlow

xStocks offers a tokenized stock service, allowing investors to trade tokenized versions of popular US stocks like Tesla in real time. While still in its early stages, it’s already showing some interesting signs of growth.

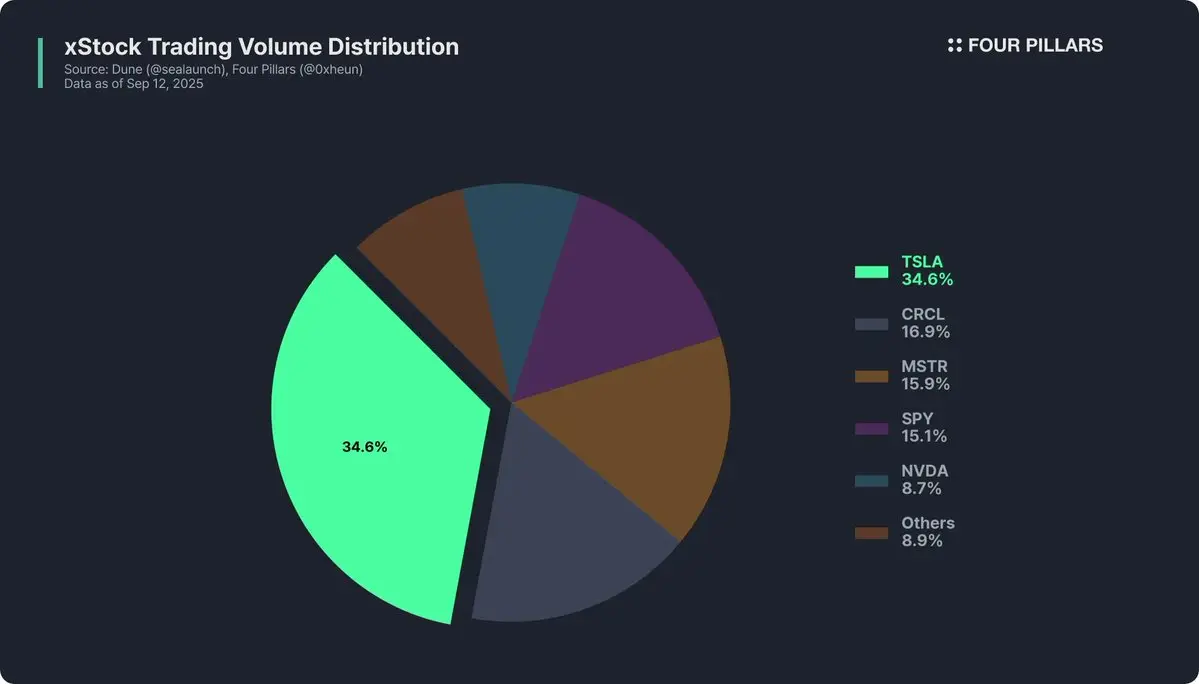

Observation 1: Trading is concentrated in Tesla (TSLA)

As in many emerging markets, trading activity has quickly concentrated on a handful of stocks. Data shows a high concentration of trading volume in the most well-known and volatile stocks, with Tesla being the most prominent example.

This concentration is not surprising: liquidity tends to accumulate in assets that retail investors already favor, and early adopters often use familiar high-beta stocks to test new infrastructure.

Observation 2: Liquidity decreases on weekends

Data shows that on-chain equity trading volume drops to 30% or less of weekday levels over the weekend. Unlike crypto-native assets, which trade seamlessly around the clock, tokenized stocks still inherit the behavioral inertia of traditional market trading hours. Traders appear less willing to trade when reference markets (such as Nasdaq and the New York Stock Exchange) are closed, likely due to concerns about arbitrage, price gaps, and the inability to hedge positions off-chain.

Observation 3: Prices move in line with the Nasdaq

Another key signal comes from pricing behavior during the initial launch period. Initially, xStocks tokens traded at a significant premium to their Nasdaq counterparts, reflecting market enthusiasm and potential friction in bridging fiat liquidity. However, these premiums gradually diminished over time.

Current trading patterns show that the token price is at the upper limit of Tesla's intraday price range and is highly consistent with the Nasdaq reference price.

Arbitrageurs appear to be maintaining this price discipline, but there are still small deviations from the intraday highs, indicating some market inefficiencies that may present opportunities and risks for active traders.

New opportunities for Korean stock investors?

South Korean investors currently hold over $100 billion in US stocks, with trading volume increasing 17-fold since January 2020. Existing infrastructure for South Korean investors to trade US stocks is limited by high fees, long settlement times, and slow cash-out processes, creating opportunities for tokenized or on-chain mirror stocks. As the infrastructure and platforms supporting on-chain US stock markets continue to improve, a new group of South Korean traders will enter the crypto market, which is undoubtedly a huge opportunity.

You May Also Like

Trump’s Tactics Reignite Crypto’s SEC Dialogue

Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Bill Passes This Month