Bitcoin Price Crashes to $75,000 Range As Broader Crypto Market Sells-Off

Bitcoin Magazine

Bitcoin Price Crashes to $75,000 Range As Broader Crypto Market Sells-Off

Bitcoin price plunged to nearly $75,000 today during a continuous and sharp, high-volume sell-off that erased more than 10% from recent highs and pushed the asset below $80,000 for the first time since April 2025.

Data shows BTC fell from a 24-hour high of $84,356 to a low of $75,644 in a matter of hours, as sellers overwhelmed bid support across major exchanges.

The move marked one of the steepest single-day declines of the year and triggered widespread liquidations in derivatives markets.

The sell-off accelerated after bitcoin price failed to hold support near $82,500. Once that level broke, price moved quickly through thin liquidity zones, with little evidence of sustained dip-buying until the mid-$70,000 range. Traders described the move as a deleveraging event rather than a gradual risk-off rotation.

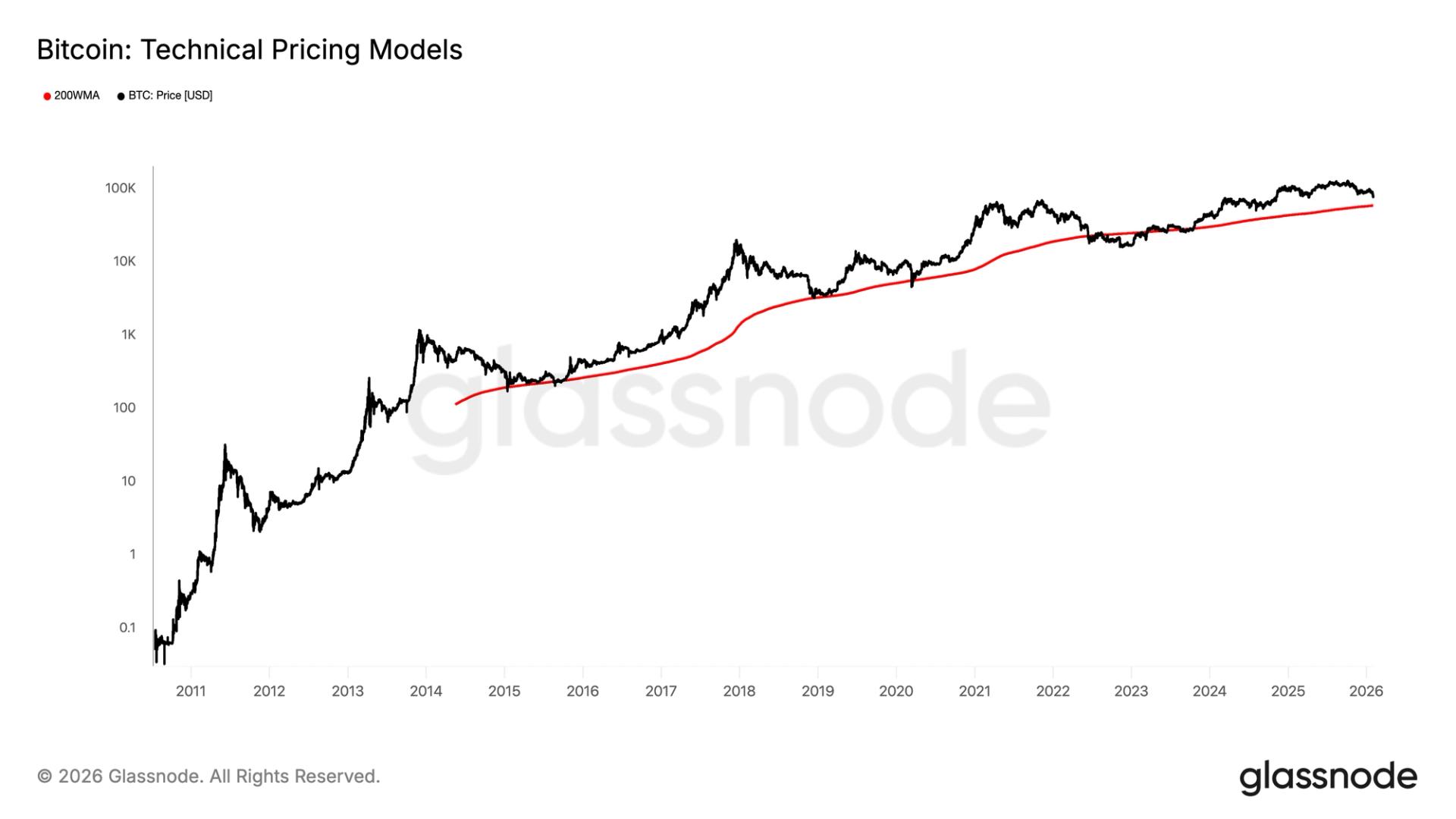

On the daily chart, the bitcoin price broke below a rising trendline that had held since late December. Price also slipped decisively under the 50-day exponential moving average near $90,000, flipping that level into overhead resistance, according to Bitcoin Magazine Pro Data.

Volume expanded during the breakdown, signaling forced exits and margin liquidations rather than low-conviction selling.

Bitcoin price analysis as the U.S. government enters partial shutdown

Despite the sharp decline, on-chain data suggests renewed interest from new buyers. Network data shows a surge in new bitcoin addresses over the past 24 hours, reaching the highest daily increase in nearly two months.

Bitcoin’s drop also outpaced most recent declines in traditional markets, but it still held up better than gold during the same window. While BTC fell roughly 6% to 8% during the sell-off, gold posted a steeper drawdown, reinforcing bitcoin’s relative strength during the volatility.

Until the bitcoin price reclaims the $82,000 to $84,000 range, traders say downside risk remains elevated. The next key support zone sits in the low-to-mid $70,000s, with longer-term focus shifting toward whether the market can stabilize.

The U.S. government entered a partial shutdown after Congress failed to pass a full-year spending package by the Friday midnight deadline, leaving several major departments temporarily unfunded.

The Senate approved a funding deal to keep most agencies running through September and a two-week stopgap for Homeland Security, but the measure awaits House approval, which cannot occur until lawmakers return from recess Monday.

The impasse is driven by Democratic demands for changes to immigration enforcement practices following the fatal shooting of two U.S. citizens in Minnesota, with divisions persisting within the House GOP.

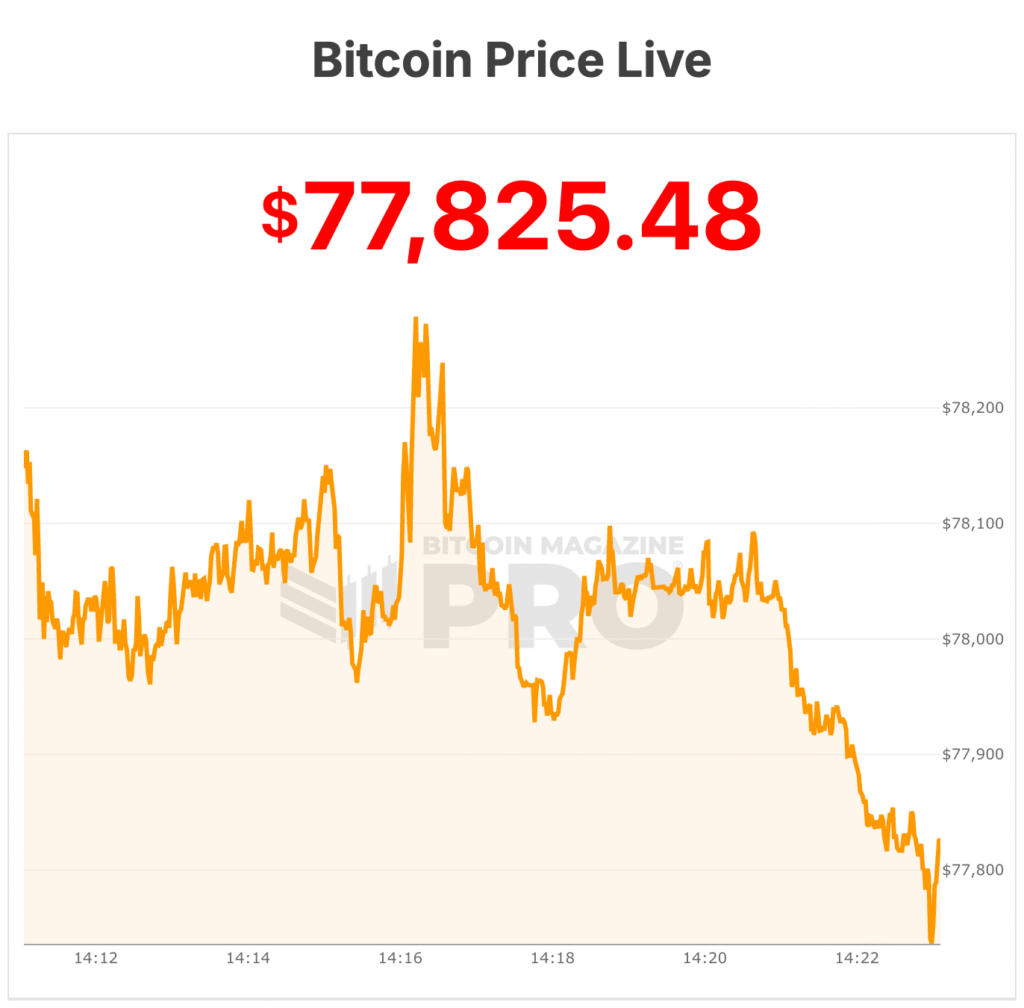

At the time of writing, the bitcoin price is trading at $77,825, down 7% over the past 24 hours, as daily trading volume reached $75 billion.

The asset is now 8% below its seven-day high of $84,368 and sits just 1% above its seven-day low of $77,534.

This post Bitcoin Price Crashes to $75,000 Range As Broader Crypto Market Sells-Off first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Why a $58,000 bitcoin is the key number for crypto investors right now

Copy linkX (Twitter)LinkedInFacebookEmail

Virtune AB (Publ) (“Virtune”) has completed the monthly rebalancing for January 2026 of its Virtune Crypto Altcoin Index ETP