Tennessee Lawmakers To Weigh Strategic Bitcoin Reserve Bill

Bitcoin Magazine

Tennessee Lawmakers To Weigh Strategic Bitcoin Reserve Bill

Tennessee lawmakers are considering legislation that would allow the state to hold bitcoin as part of its public financial reserves.

If passed, the measure would place Tennessee among a small group of U.S. states that have moved to formalize bitcoin holdings through statute.

House Bill 1695, known as the Tennessee Strategic Bitcoin Reserve Act, was filed earlier this month by Rep. Jody Barrett (R–Dickson). The bill is scheduled for consideration during the current session of the 114th Tennessee General Assembly.

It would grant the State Treasurer authority to invest a limited share of select state funds in bitcoin.

The bill’s findings cite inflation as a central concern. Lawmakers state in the bill that rising prices erode the real purchasing power of assets held in the general fund, the revenue fluctuation reserve, and other state pools.

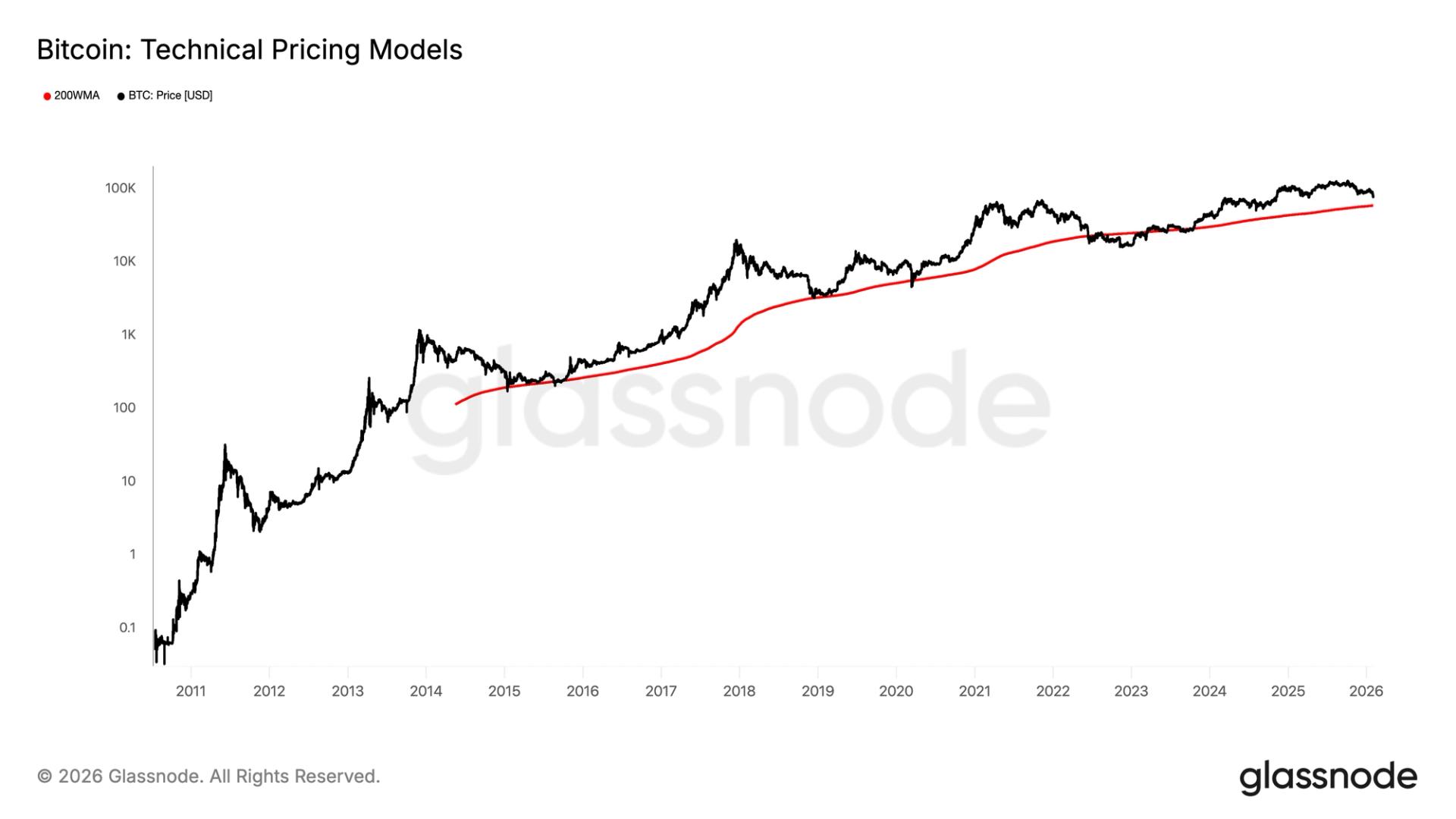

Bitcoin is described in the legislation as a decentralized digital commodity with a fixed supply and global liquidity. The bill argues that a fiduciary investor may use such an asset to improve long-term, inflation-adjusted returns.

“This is about responsible stewardship of public finances,” Barrett said in a statement. He compared bitcoin to gold and framed it as a hedge against inflation.

Tennessee follows a growing wave of U.S. states exploring Bitcoin-focused policy, with lawmakers in South Dakota and Kansas introducing bills that would allow public funds to be allocated to bitcoin or placed into a strategic Bitcoin and digital assets reserve.

At the same time, states like Rhode Island and Florida have revived or reintroduced legislation aimed at studying Bitcoin, easing its use, or potentially adding it to state balance sheets under defined oversight frameworks.

10% of Tennessee’s general fund into bitcoin

Under the proposal, the Treasurer could allocate funds from the general fund, the revenue fluctuation reserve, or other state funds approved by lawmakers. Bitcoin exposure would be capped at 10% of each eligible fund at the time of purchase.

Annual purchases would be limited to 5% per fiscal year until the cap is reached. The bill allows passive price gains to push holdings above the cap without forcing sales.

The legislation restricts investments to bitcoin only. It bars allocations to other cryptocurrencies or digital assets. Bitcoin could be held directly by the state, through a qualified custodian, or via an exchange-traded product tied solely to bitcoin.

All forms of exposure would count toward the same cap.

The bill sets detailed custody standards. A “secure custody solution” must store private keys in encrypted hardware kept offline in at least two locations. Access would require encrypted channels and multi-party authorization.

Audit logs would be mandatory. Custody systems would face annual third-party code reviews and penetration tests. Providers would need disaster recovery plans.

Consistent transparency checks

Transparency is a core feature of the proposal. Every two years, the Treasurer would need to publish a public report. The report would list the amount of bitcoin held, its dollar value at purchase and at the end of the period, and a summary of transactions.

It would also include a cryptographic proof that allows third parties to verify on-chain balances. Security assessment summaries would be available upon request.

The bill also allows the Treasurer to create a program to accept bitcoin for taxes, fees, or other state obligations. Participation would be voluntary. Any bitcoin received would be transferred to the general fund and recorded at market value. Agencies would be reimbursed in dollars.

Supporters say the structure reflects Tennessee’s broader approach to asset management. The state oversees more than $132 billion in assets, including one of the top-rated public pension systems in the country.

“Even strong balance sheets face risks that traditional assets do not hedge,” said David Birnbaum, president of the Tennessee Bitcoin Alliance. He said bitcoin offers diversification due to its low correlation with other asset classes.

The bill directs the Treasurer to publish a bitcoin investment policy by January 1, 2027. A full performance and risk review would be due by October 1, 2032.

Lawmakers would then decide whether to continue, revise, or repeal the program.

If approved, the act would take effect on July 1, 2026.

This post Tennessee Lawmakers To Weigh Strategic Bitcoin Reserve Bill first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Why a $58,000 bitcoin is the key number for crypto investors right now

Copy linkX (Twitter)LinkedInFacebookEmail

Virtune AB (Publ) (“Virtune”) has completed the monthly rebalancing for January 2026 of its Virtune Crypto Altcoin Index ETP