Will XRP Price End 2025 in Negative Zone Despite ETF Inflows?

Ripple’s native cryptocurrency, XRP XRP $1.86 24h volatility: 1.0% Market cap: $112.71 B Vol. 24h: $2.05 B , continues to be under strong selling pressure and is already trading 7% down since the beginning of 2025. Amid the strong selling pressure coming from whales and long-term holders, the XRP price is on a 6-month downtrend. This comes despite the continuous positive inflows into spot XRP ETFs.

XRP Price May See End of Two-Year Bull Run

The ongoing market cycle risks breaking a two-year run of positive annual returns XRP. XRP price gained 81% in 2023 and surged 238% in 2024, supported by improving regulatory clarity and strong speculative interest. In contrast, this time the altcoin has shown negative returns, in tune with the Bitcoin performance.

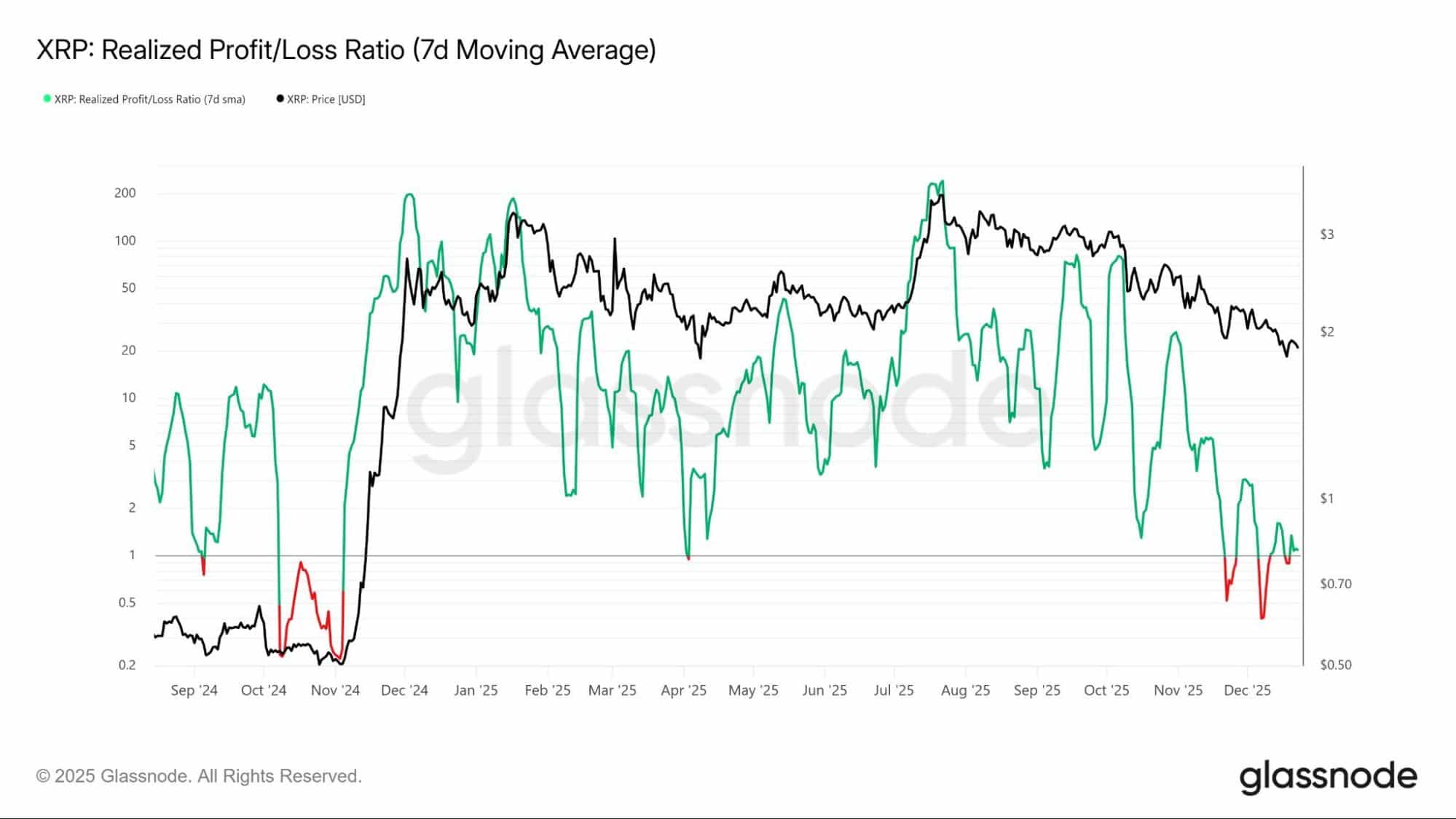

On-chain realized profit and loss data indicate that selling activity in the fourth quarter was very high. XRP holders exited positions at a loss, triggering a major drop in investor confidence.

Historically, large-cap token investors have tended to hold through drawdowns in anticipation of a recovery rather than locking in losses. However, the investor behaviour has shifted during this cycle.

The willingness to sell at a loss reflects growing uncertainty around XRP’s near-term outlook. Moreover, the risk aversion sentiment has outweighed long-term conviction, thereby leading to continuous downside pressure.

XRP Realized Profit Loss | Source: Glassnode

Furthermore, the trading activity on the XRP Ledger has also declined by the end. Network data shows that the number of active transacting addresses fell to a monthly low of 34,005. The decline in participation suggests the absence of active participation from both retail and institutional players.

Spot XRP ETF Inflows Remain Strong

US-based spot XRP ETFs have so far avoided any outflows since their launch last month. Total net inflows have reached $1.13 billion, pushing combined assets under management (AUM) to approximately $1.25 billion.

On Dec. 23 alone, XRP ETFs recorded net inflows of $8.19 million. Data from SoSoValue shows that Franklin Templeton’s XRPZ led yesterday’s inflows, while other products reported flat flows amid subdued holiday-period trading activity.

XRP ETF Inflows | Source: SoSoValue

Canary Capital’s spot XRP ETF (XRPC) continues to lead the group, with cumulative net inflows of $384 million, followed by the XRP ETF offerings from Bitwise and Grayscale.

At the same time, institutional investors are rotating capital into XRP ETFs from Bitcoin and Ethereum ETFs. This reflects improving sentiment around XRP and more favorable market developments.

nextThe post Will XRP Price End 2025 in Negative Zone Despite ETF Inflows? appeared first on Coinspeaker.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Ripple-Backed Evernorth Faces $220M Loss on XRP Holdings Amid Market Slump