Morgan Stanley Tells Advisors Managing $2 Trillion To Allocate Up To 4% To Bitcoin

Morgan Stanley Wealth Management’s Global Investment Committee (GIC) has advised clients managing $2 trillion to allocate up to 4% of client portfolios to Bitcoin, and likened the leading crypto to “digital gold.”

”This is huge,” said Bitwise Chief Executive Officer (CEO) Hunter Horsley in a post on X. ”GIC guides 16,00 advisers managing $2 trillion in savings and wealth for clients. We’re entering the mainstream era.”

In an October report released last week, the firm’s GIC recommended that advisors allocate between 2% to 4% of client portfolios to BTC, depending on risk appetite.

It called Bitcoin ”a speculative and increasingly popular asset class” but placed it in the category of “real assets.” It also likened Bitcoin to digital gold.

Morgan Stanley Recommends 2% Allocation For More Conservative Portfolios

Morgan Stanley recommended that advisors allocate up to 4% of “Opportunistic Growth” portfolios to Bitcoin. Such portfolios are structured for investors with a higher risk tolerance seeking higher returns.

For more conservative portfolios, it recommended that advisors allocate up to 2%. For portfolios optimized to for wealth preservation and income, it recommended a 0% allocation to BTC.

Morgan Stanley said portfolio managers who add crypto to their portfolios should rebalance them “on a regular, periodic basis,” preferably quarterly.

“Such rebalancing will dampen the potential for swelling positions, which could mean outsized portfolio-level volatility and cryptocurrency risk contributions in periods of macro and market stress.”

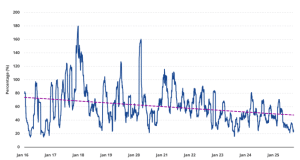

While Bitcoin’s 30-day trailing volatility has fallen over the past few years, Morgan Stanley said it ”could experience more elevated volatility and higher correlations with other asset classes in periods of macro and market stress.”

Bitcoin 30-day trailing volatility (Source: VanEck)

The GIC recommendation comes as Bitcoin soared to a new all-time high (ATH) of $125,559.21 over the weekend. It has since retraced to trade at $123,549.71 as of 1:32 a.m. EST after falling 1% in the past 24 hours, according to CoinMarketCap data.

Even with the recent correction, the crypto market leader is up over 11% over the past month. Fueling that rally is a surge in inflows into spot Bitcoin ETFs and a drop in the amount of BTC on exchanges to a six-year low.

Bitcoin ETFs Have Made It Easier To Buy BTC, Morgan Stanley Says

Morgan Stanley also noted “product innovation” in the crypto and financial sectors. This includes the launch of spot Bitcoin ETFs (exchange-traded funds) in the US in January last year, which the firm says opened up “the possibility of allocating to the emerging asset class in a multiasset portfolio.”

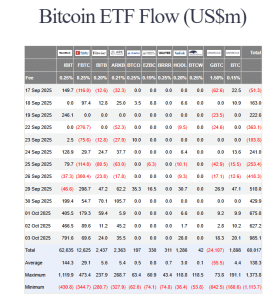

Just last week, US spot BTC ETFs pulled in over $3 billion, data from Farside Investors shows.

US spot BTC ETF flows (Source: Farside Investors)

The best day last week was on Friday, when investors pumped $985.1 million into the products.

The most popular of these products has been BlackRock’s iShares Bitcoin ETF, which trades under the ticker symbol “IBIT.” Most of the inflows seen last week were into IBIT, which now holds over 3% of BTC’s supply and has recorded $62.635 billion in cumulative inflows since launch.

You May Also Like

Waarom Kyrgyzstan via Binance inzet op een stablecoin

Saudi blockchain real estate offers tokenized investment under Vision 2030