Bitcoin and Ethereum price direction remain uncertain amid lower trading volumes and volatility ahead of the holiday season. However, experts reveal signs of a possible Santa Claus rally as options traders are turning bullish.

Bitcoin and Ethereum Options Traders Are Becoming Less Bearish

On December 22, crypto market expert Matrixport revealed a shift in sentiment among Bitcoin and Ethereum options traders. Since late August, the options skew for both crypto assets remained firmly negative, which signals downside protection.

Notably, Bitcoin’s 25-delta skew is more bearish than for Ethereum, with deeper pullbacks recorded in mid-November. Matrixport claimed this pattern reflected heightened demand for put options, especially during periods of market stress.

Bitcoin and Ethereum 25-Delta Skew. Source: MatrixportRecent stability following BOJ rate hike and US macro events led to a modest lift in skews. However, these Bitcoin and Ethereum skews remain below zero. The rebound in skews signals that traders are still pricing in downside risk, but there is evidence that options traders are becoming less bearish.

This sudden shift marks the first positive signals from options traders since the October 10 crypto market crash. It indicates traders are likely anticipating potential upside in Bitcoin and Ethereum prices.

Will BTC and ETH Prices Witness a Santa Claus Rally?

On-chain analyst Axel Adler Jr. claimed the broader macroeconomic backdrop appears supportive, with “no clear obstacles” that could prevent Bitcoin from staging a “Santa Claus rally.”

Bitcoin Regime Score is bullish, but it has not confirmed a bullish momentum yet. Short liquidations are reinforcing the asymmetry in favor of buyers.

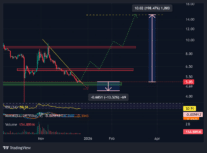

Bitcoin Regime Score. Source: Axel Adler Jr.Crypto analyst Daan Crypto Trades pointed out that Bitcoin is still sitting at the support of the .382 Fibonacci retracement level of the entire cycle. This remains a key area to defend for the bulls on the high timeframe.

The December 26 Bitcoin and Ethereum options expiry as well as the annual closing price will set the direction of BTC and ETH prices in the coming weeks. Notably, experts say the crypto market is in the early bear market phase.

Bitcoin Weekly Price Chart. Source: Daan Crypto TradesBTC price has jumped 1% over the past 24 hours, currently trading at $89,751. The 24-hour low and high are $87,613 and $89,859, respectively. Furthermore, trading volume has increased by over 70% in the last 24 hours, supporting a rebound.

ETH price is also trading 1% higher above $3,000, with an intraday high of $3,056. Trading volume has shot up 92% over the past 24 hours.

Source: https://coingape.com/bitcoin-and-ethereum-options-traders-turn-slightly-bullish-santa-claus-rally/