Bitcoin is once again trading in a tightly compressed range near the $88,000 level, but derivatives data suggests this calm may not last much longer.

While price action looks muted on the surface, the underlying liquidation structure and momentum indicators point to rising tension across the market.

- Bitcoin is consolidating near $88,000 despite heavy leverage on both sides of the market.

- Liquidation data shows a dense cluster of short positions above $89,000-$90,000.

- RSI and MACD suggest stabilization, not a confirmed trend shift.

The exchange liquidation map shows a clear imbalance between long and short positioning clustered around the current price. Short-side liquidation leverage increases sharply above the $89,000-$90,000 area, while long-side liquidations are stacked lower, closer to the mid-$85,000 zone. This creates a narrow corridor where price is effectively pinned between opposing leverage pools.

Such structures often act like magnets for volatility. A decisive move in either direction could trigger a cascade of forced liquidations, accelerating price action once the range breaks. The fact that cumulative short liquidations rise more steeply above spot suggests that an upside move could be particularly aggressive if momentum builds.

Price consolidates as volatility remains suppressed

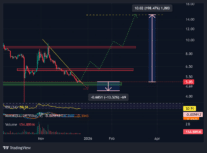

On the 4-hour chart, Bitcoin continues to trade sideways following a sharp selloff earlier in the month. Since then, price has stabilized, forming a broad consolidation range between roughly $85,000 and $92,000. Volume has gradually declined during this phase, a classic sign that traders are waiting for confirmation before committing to larger positions.

Despite several intraday spikes, each attempt to reclaim higher levels has stalled, reinforcing the idea that the market is coiling rather than trending. This type of structure often precedes an expansion in volatility, especially when combined with heavy derivatives exposure.

RSI and MACD signal cautious recovery, not strength

Momentum indicators are sending mixed but informative signals. The 14-period RSI on the 4-hour timeframe is hovering slightly above 53, indicating neutral conditions with a mild bullish bias. Importantly, RSI is no longer printing oversold readings, suggesting that selling pressure has eased, but it is also far from overbought territory.

MACD tells a similar story. The histogram has flattened near the zero line, while the MACD and signal lines are attempting a shallow bullish crossover. This points to early stabilization rather than a confirmed trend reversal. In past cycles, such setups during low volatility phases have often preceded sharp directional moves once price escapes its range.

What comes next for Bitcoin?

With leverage building on both sides and spot price stuck in a narrow band, Bitcoin appears to be approaching a decision point. A push above the $89,000-$90,000 region could unlock a wave of short liquidations, potentially fueling a rapid upside move. On the downside, failure to hold above $86,000 would expose heavily leveraged longs and could drag price lower before any meaningful rebound.

For now, Bitcoin remains in balance, but the liquidation map makes one thing clear: the current calm is fragile, and the next move is likely to be fast.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

AuthorRelated stories

Next article

Source: https://coindoo.com/bitcoin-stalls-near-88k-as-liquidation-pressure-builds/